Unlocking Your Golden Handcuffs: How Common is Accelerated Vesting on Change of Control? - 8/31/08

Sunday, August 31, 2008

Unlocking Your Golden Handcuffs: How Common is Accelerated Vesting on Change of Control?

http://founderresearch.blogspot.com/2008/08/unlocking-your-golden-handcuffs-how.html

"I'm negotiating my equity-compensation package. How frequently do people get accelerated vesting on change of control?"

In private ventures, vesting of equity stakes is the major form of golden handcuffs (see posts here, here, and here) used to keep executives at their ventures. However, other terms, such as accelerated vesting on change of control (AVCoC), can shorten those vesting periods. (See Brad Feld’s description of AVCoC in the middle of this post, or the VentureHacks overview here.)

I

recently got an email from a serial entrepreneur who has been brought

on as the head of finance and operations in a mobile-services start-up.

One of his questions was: How often do new-venture executives get AVCoC? If

it’s not common for them to get it, he wouldn’t push for it and would

focus his negotiating leverage on another term, but if it’s common, he

wanted to push hard for it. (He felt that the start-up might be the

subject of M&A activity in the future, and had already experienced

working for a large company after a prior venture of his had been

acquired.)

I decided to dive into our fresh CompStudy

data on equity terms to examine how common AVCoC is within new-venture

management teams. I took a look at three levels of data: What is the

overall percentage of executives receiving AVCoC? Does the percentage

differ by level in the organization (e.g., CEO vs. other C-level

executives vs. VP-level executives)? And has the percentage been

changing over the last few years?

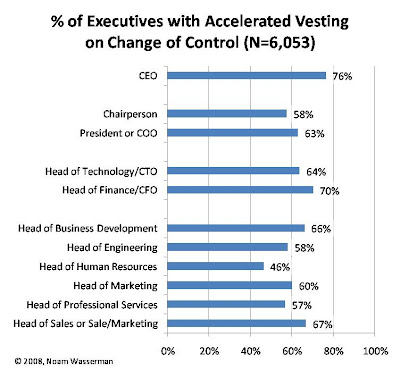

For these analyses, I combined our 2005, 2006, 2007, and 2008 IT datasets, which gave me a total of 6,053 executives from 1,202 private ventures.

Overall, the percentage of executives receiving AVCoC was 65.5%. However, as shown in the chart below, the percentage varied from a high of 76.4% for CEOs down to 46.3% for the Head of Human Resources. (I only show the positions for which I had at least 100 data points.)

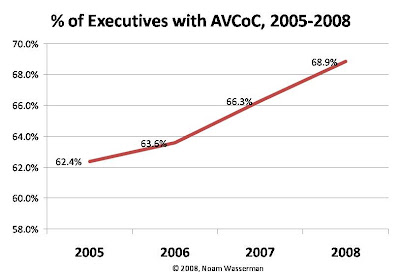

Over time, the percentage has been steadily increasing.

As shown below, in 2005, 62.4% of executives received AVCoC, but by

2008, it had steadily increased to 68.9%. This increase was relatively

consistent across the positions in the chart above.

Questions:

- When you were in a similar position, how much did you push (or not push) to receive AVCoC? Why?

- There

are good reasons why many boards and investors do not want to give

executives AVCoC (some of which are covered towards the bottom of Brad Feld's post). In your experience, what arguments are most and least effective for getting boards to give it? - Did the strength of those arguments differ by whether the person was a founder vs. a non-founder? By the executive's position (e.g., C-level vs. VP-level person, as per the first chart above) or other characteristics?

- Any thoughts on the increase in AVCoC from 2005-2008 (as per the second chart above)?

| Topic | Replies | Likes | Views | Participants | Last Reply |

|---|---|---|---|---|---|

| RSUs & McDonalds CEO Sex Scandal | 0 | 0 | 243 | ||

| ESPPs Provided Big Gains During March-June Market Swings | 0 | 0 | 231 | ||

| myStockOptions.com Reaches 20-Year Mark | 0 | 0 | 256 |